3 min read

CLONES

When leadership narrows and a few dominant names drive the gains, it's rarely a sign of strength. Rallies built on concentration often reflect habit,...

2 min read

Michael Miller

:

Jun 1, 2025 4:15:00 PM

Michael Miller

:

Jun 1, 2025 4:15:00 PM

Or Just Drowned Out by a Better Story?

Growth still runs the show. The S&P 500 continues to be driven by a handful of mega-cap tech names, the Magnificent Seven, while non-US equities and value-oriented strategies lag behind. The stark divergence in performance, despite wide valuation gaps, looks like confirmation that worries about what one pays for a business are obsolete.

But that’s not the whole story, literally.

In two separate conversations last month, I was struck by the dichotomy in investor belief systems. In the first, a self-professed value purist expressed concern that even if value managers still exist, few can credibly stick to their discipline when faced with internal succession and business pressure. In the other, a sophisticated allocator told me plainly that he has no interest in any deep value strategy, period.

What unites these opposing views is a deeper concern. In a world where market prices are increasingly driven by narrative, is there still room for fundamental analysis?

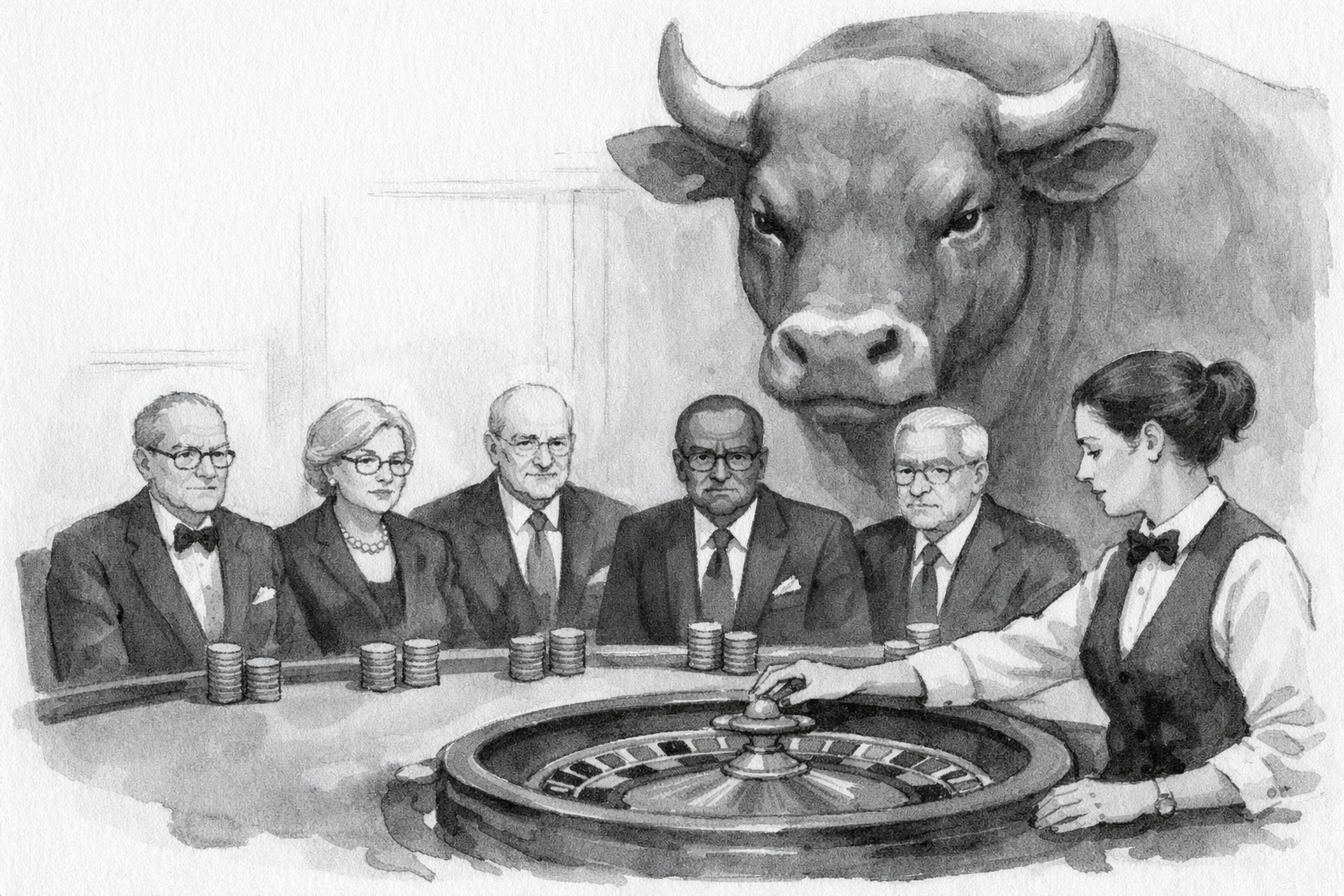

It’s a fair question. Today’s markets are not arenas of debate over discounted cash flows, they’re stages for storytelling; essentially, assessing fundamental value doesn’t set prices anymore, attention does. In a world governed by algorithms, memes, momentum, and social media cycles, prices move because a story catches fire.

The Seduction and Danger of Story-Driven Markets

Storytelling is powerful. It explains the meteoric rise (and often crash) of everything from meme stocks to mega-caps. It allows investors to believe in the exponential, the disruptive, the inevitability of “this time is different.” And to be clear, stories aren’t inherently bad; in fact, they often point to real innovation or changing paradigms.

But the danger comes when stories substitute for analysis, when narrative momentum overwhelms evidence. At that point, investing becomes performance art. That’s how you get stocks trading at 7x sales and 31x earnings with large shareholders explaining away drawdowns as “just part of the vision.”

Let’s take Carvana as a case study. Over the past decade, the company scaled revenue from $131 million to nearly $15 billion. That’s a compelling growth story, and grounded in reality. But the stock? It surged during COVID not because fundamentals changed dramatically, but because the story did: “Digital disruption,” “used car renaissance,” “Amazon of autos.” Valuation became irrelevant until the narrative cracked. Then, sentiment reversed just as violently, and the stock collapsed.

Only then did fundamentals re-emerge. Not in headlines, but in quiet diligence: balance-sheet improvements, operational leverage, capital discipline. That’s when thoughtful investors, those who weren’t chasing the narrative, stepped in.

Value Investing Doesn’t Need a Comeback, Just Renewed Conviction

This is where our philosophy diverges from the crowd. We don’t need a value “renaissance” to justify our strategy. In fact, we benefit from its unpopularity. Why? Because value investing isn’t a bet on a style, but on discipline.

Our work begins when the storytelling ends, when prices disconnect from reality, either on the upside or the downside. The goal isn’t to ride the narrative. It’s to identify when the market has priced a business as if the story is over, when in fact, it’s only just being rewritten. This is the core of our approach: to find and support the managers who can both assess intrinsic value and withstand the psychological toll of being early, contrarian, and temporarily unpopular. That’s hard. But it’s also where enduring returns are made.

While much of the industry is focused on not missing the next big wave, we aim to protect our clients from becoming the last to leave the party. We fully acknowledge that in a narrative-driven market, momentum strategies can work, sometimes for long periods. And yes, some investors want exposure to what’s working now. But our responsibility is not to deliver the strategy they want, it’s to deliver the outcomes they need. And those two things are not always the same.

In a world intoxicated by stories, discipline is the true contrarian stance. It doesn’t require headlines or consensus. It requires conviction, process, and the courage to appear wrong until the moment you’re right. So no, value investing isn’t dead. It’s just harder. Less popular. Less visible. And in that, we see opportunity. Let others chase the story. We’ll continue underwriting reality.

3 min read

When leadership narrows and a few dominant names drive the gains, it's rarely a sign of strength. Rallies built on concentration often reflect habit,...

3 min read

Notes from Hong Kong on Travel, Momentum, and What Might Be Shifting

4 min read

One of the great privileges of our work is that it demands a beginner’s mindset and a commitment to continuous learning, no matter how experienced we...