3 min read

BOOM ON BORROWED TIME

Foundations and Fault Lines

2 min read

Michael Miller

:

Nov 24, 2025 3:45:00 PM

Michael Miller

:

Nov 24, 2025 3:45:00 PM

The past few weeks were a good reminder of how strange markets can be, yet momentum has shifted in ways that feel familiar to anyone who has watched them long enough. Some areas that once ran hot have cooled. Others that rarely get attention have started to matter again. None of this is unusual.

The more interesting part of November came at the tail end with the latest AI earnings spectacle. A big company posted strong numbers, offered the usual optimism, and delivered everything investors have been conditioned to celebrate. And yet the stock swung almost eight percent in the other direction. It now sits well below its recent highs.

For years, the message has been simple: hold on, buy more, trust the AI/big tech story. One day that won’t work. When that day arrives, the market will stop handing out easy lessons and start offering the kind that stay with you. Real bear markets bring sharp declines, sharp rallies that go nowhere, and long stretches of doubt. Many people investing today have never been through one. Many who have been through one have forgotten what it’s like. And plenty of people have convinced themselves that certain parts of the market cannot fall like everything else.

They can.

Is this the start of something bigger?

Yes. The economics of AI spending are stretched and debt will eventually play a role in resetting expectations because markets do not ignore uncomfortable facts indefinitely.

So we go back to the part that really matters: staying grounded in who we are.

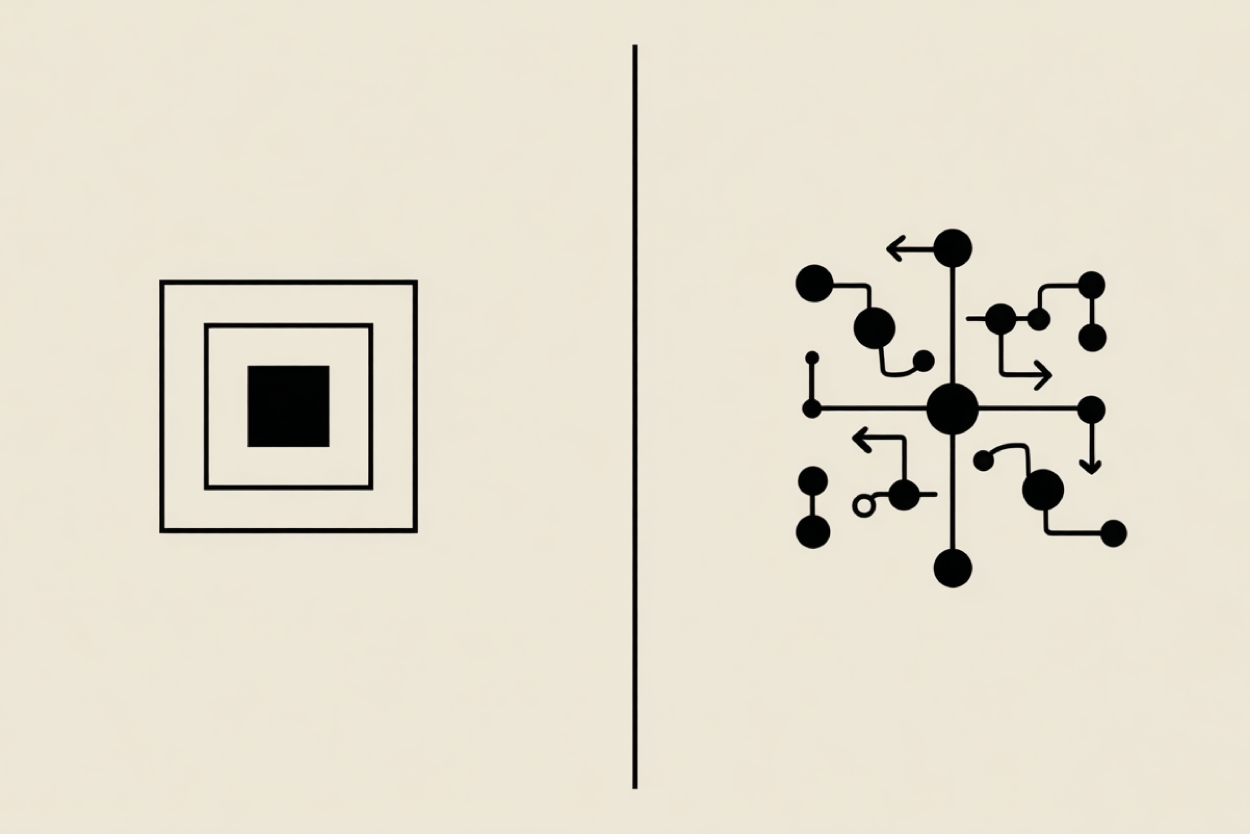

Diversification, valuation discipline, and contrarian thinking have all fallen out of favor as crowds chase whatever feels certain. Sophistication now gets defined as tighter models, sharper forecasts, and a level of precision that disappears as soon as markets shift. The comfort is appealing, but the truth underneath is simple. No model knows what happens next, no benchmark guarantees the returns needed to fund a mission, and no amount of statistical confidence changes the reality that real life does not move in straight lines.

We often hear comments that reflect a desire for predictability over honesty. The idea that broad exposure delivers clean, dependable ranges of future returns sounds calming until the low end of those ranges comes into view and the consequences become real. Then the explanation that “it was within the model,” doesn’t make the outcome any easier to live with.

There is a different path, though not an easier one. It requires time, patience, curiosity, and a willingness to sit with uncertainty. It requires actual learning: managers, strategies, cycles, behaviors, all of it. It is harder to package and harder to market, which may be why so many people have tried to run from it, but it remains the most durable way to navigate markets that do not care about our need for reassurance.

As we look ahead, the rules remain the same:

Follow these long enough and you’ll usually win. The path is not always steady and rarely smooth, but comfort has never been the goal; the goal is long-term success in the face of a world that keeps trying to distract you from core truths.

We appreciate our clients’ trust and remain committed to the work that actually matters: helping them make decisions that stand the test of time, no matter the story the market is telling on any given day.

3 min read

Foundations and Fault Lines

5 min read

As the first in our “Elsewhere” series, this dispatch from Egypt showcases just one of many opportunities we’re exploring as the mainstream...

14 min read

Today’s Market Landscape