2 min read

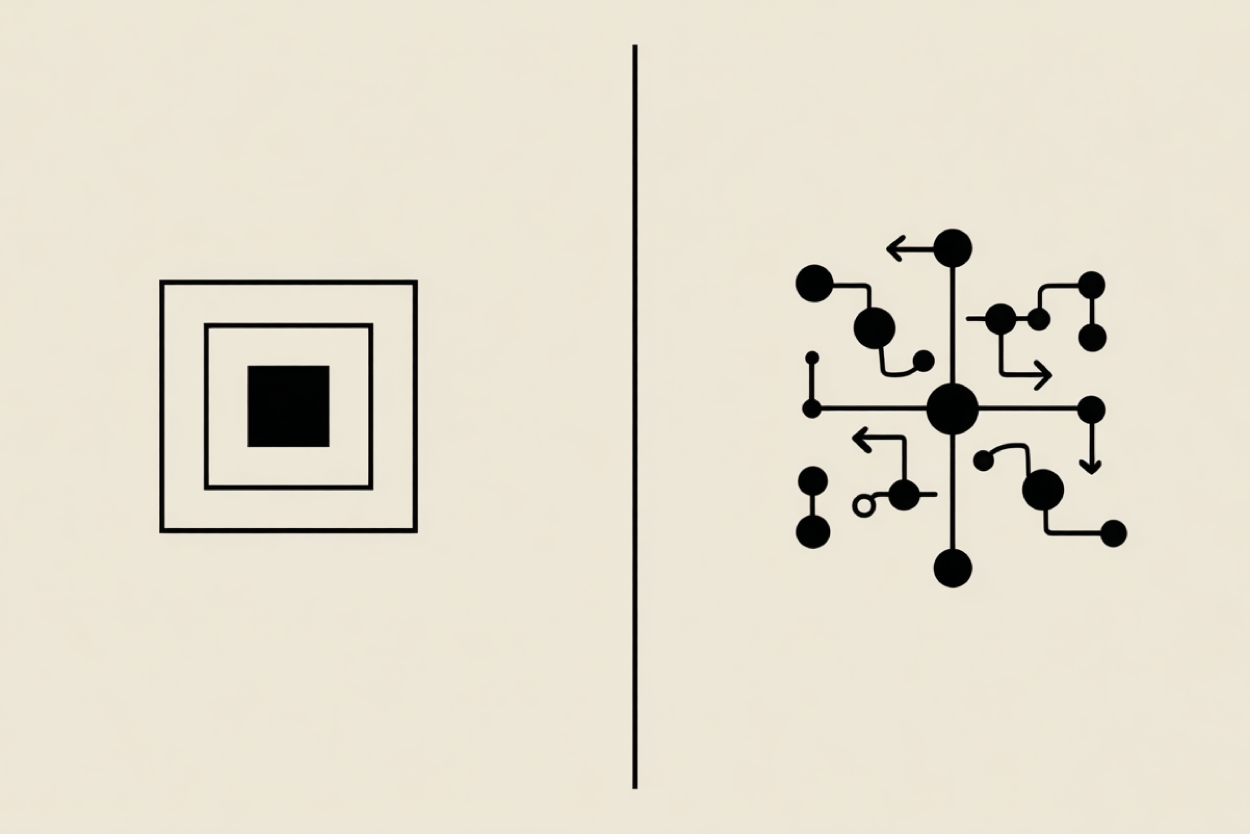

WHY SIMPLE INVESTMENT FRAMEWORKS OUTPERFORM COMPLEX ONES

The past few weeks were a good reminder of how strange markets can be, yet momentum has shifted in ways that feel familiar to anyone who has watched...

As the first in our “Elsewhere” series, this dispatch from Egypt showcases just one of many opportunities we’re exploring as the mainstream investment landscape grows more homogenous and the real potential increasingly lies off the beaten path. As markets grow more concentrated and crowded, we’re focused on going where others aren’t. That means looking beyond dominant benchmarks to uncover markets that offer not just diversification, but fundamentally different ways to win. These trips aren’t about chasing headlines or placing oversized bets on any one country; they’re about broadening the opportunity set, gaining firsthand insight, and building portfolios that don’t rely on a handful of familiar names doing well in perpetuity.

Time Fears the Pyramids

Notes from Egypt on Travel and Investing

I recently returned from my trip to Egypt. Four days, eight companies, countless impressions, one country in flux, and one simple realization: some things you learn in a boardroom, and some you only learn when the dust gets into your clothes.

We met with a commercial bank, a snack-food company, a real-estate firm, a hospital chain, a cheese producer, a chemicals conglomerate, an investment bank, and on the final day, Orascom, the crown jewel of Egypt’s construction industry. By the end of it all, I was jet-lagged, sun-beaten, and more convinced than ever that the best ideas rarely show up on a spreadsheet alone. You have to go find them.

Let me say this plainly. The trip wasn’t about sightseeing. It was about trying to understand a country that, on paper, most investors would cross off their list without a second thought.

The View from the Ground

The infrastructure boom in Egypt is staggering. At Orascom, we toured a massive wastewater facility and the under-construction Magdi Yacoub Global Heart Center, a stunning piece of architecture and a moral statement in one. The hospital will provide world-class cardiac care to anyone, for free. It’s funded by a private foundation, built by Egyptians, staffed by Egyptians, and with design cues drawn from the new Grand Egyptian Museum (also built by Orascom). Even progress here feels ancient.

Orascom, by the way, trades at 5x earnings with an 8% dividend, posts a mid-teens ROE, and carries no net debt as of March 2025. These aren’t theoretical numbers but an operational reality. The Cairo metro area is expanding like wildfire, and Orascom is at the center of it all: new highways, new rail, new housing, new cities. One undertaking, the Ras El-Hekma coastal development project, intends to build a new state-of-the-art city on the Ras al-Hikma peninsula, representing the largest investment in Egypt’s history with a projected $150 billion development budget (or just under 40% of Egypt’s annual economic output).

However, its capital markets are not robust; many companies trade at very low prices and there are clear reasons for this:

Despite all this, and despite one of the lowest happiness rankings on earth, nearly everyone we met was warm, proud, and forward-looking. It’s not exactly a pretty picture. But it could be a different one in the future:

The Risk of Being Wrong Alone

One of my traveling companions shared an exciting perspective and put it simply: “Ten years from now, people are going to look back at 2025 as one of the great investment entry points.” When you add up the potential dividend yield, profit growth, and absurdly low valuations, it’s possible to envision strong returns, potentially up to 15-20% annually over the next five years. Even with a more cautious outlook, returns of 5-8% are achievable, which could outpace what we expect from US large caps in favorable conditions.

So why are so few looking here?

Because risk isn’t the enemy, being wrong alone is. Most people would rather lose with the herd than win on their own. That’s not investing; that’s fear.

There’s a billboard outside Giza that reads: “Man fears time, but time fears the pyramids.” Clever marketing, but it sticks with you. These monuments outlasted. They were built for permanence in a world that now changes by the hour.

Hatshepsut, Value, and the Long Game

Language has a memory. The word pharaoh (pr ꜥꜣ, “great house”) was coined not just as a title, but as a necessary correction. It arose during the reign of Hatshepsut, Egypt’s second confirmed female ruler, who didn’t fit the mold of a king as a man. The language had to evolve to match the reality.

Her reign, from 1479 to 1458 BC, was a period of peace, trade, and architectural ambition. She built temples, stabilized the kingdom, and elevated Egypt’s influence abroad. But after her death, a campaign began to erase her legacy. Statues were buried, inscriptions were defaced, and her memory attacked.

It didn’t work. Her statue still stands today, at the Met in New York no less, a symbol of resilience and misjudged value.

Markets also tend to shun what feels unfamiliar, underpricing the uncomfortable. But what was once overlooked can be reappraised, and revealed as not just legitimate, but exceptional. Egypt may well be in the same position now.

What Travel Reminds Us

Here’s the thing. We don’t have to invest in Egypt. We don’t have to be in Africa at all. But the better question is, why wouldn’t we?

If you can reasonably pencil out strong, sustainable IRRs, and the biggest headwind is perception rather than fundamentals, then what exactly are we waiting for?

Travel is proverbially good for the soul, yes, but it’s better for the mind. It sharpens judgment, disrupts assumptions, and reveals what data alone cannot. And maybe more importantly, it reminds us that value isn’t always visible from 30,000 feet.

I don’t know what the world will look like in five years. The war in the Middle East is escalating. Egypt is vulnerable. But progress is happening. Good people are still building things that matter. And great investments, like the pyramids, are built to last.

2 min read

The past few weeks were a good reminder of how strange markets can be, yet momentum has shifted in ways that feel familiar to anyone who has watched...

14 min read

Today’s Market Landscape

4 min read

Thinking about the past year at Crewcial, a John Lennon quote keeps coming to mind: “Being honest may not get you a lot of friends, but it’ll always...