4 min read

A SEPTEMBER TO REMEMBER

A September to Remember? Rates, Labor, and Market Domino Effects Setting the Stage As markets came back from the long Labor Day weekend, labor...

2 min read

Albert Lim

:

Aug 26, 2025 9:59:08 AM

Albert Lim

:

Aug 26, 2025 9:59:08 AM

Few would dispute that Berkshire Hathaway, founded by Warren Buffett in 1965, has been one of the greatest long-term investments over the past century. From 1965 to 2024, the stock has returned 19.9%, nearly double that of the S&P 500 Index’s 10.4%. However, at the end of 2023, Berkshire’s stock had underperformed the S&P 500 Index by:

Did this mean Berkshire was a dud of an investment and losing its edge?

Asset owners need to deal with these questions not only among their holdings, but their investment managers and advisors. Investors naturally hope for smooth, consistent performance, both in absolute and relative terms, but that’s unrealistic unless they’re parked entirely in cash; and while cash offers predictability, it also guarantees long-term erosion of wealth. Even top-tier investments experience extended periods of lagging performance; from 1981 to 2024, Berkshire underperformed the S&P for 15 of 44 calendar years, including three straight years from 2003–2005.

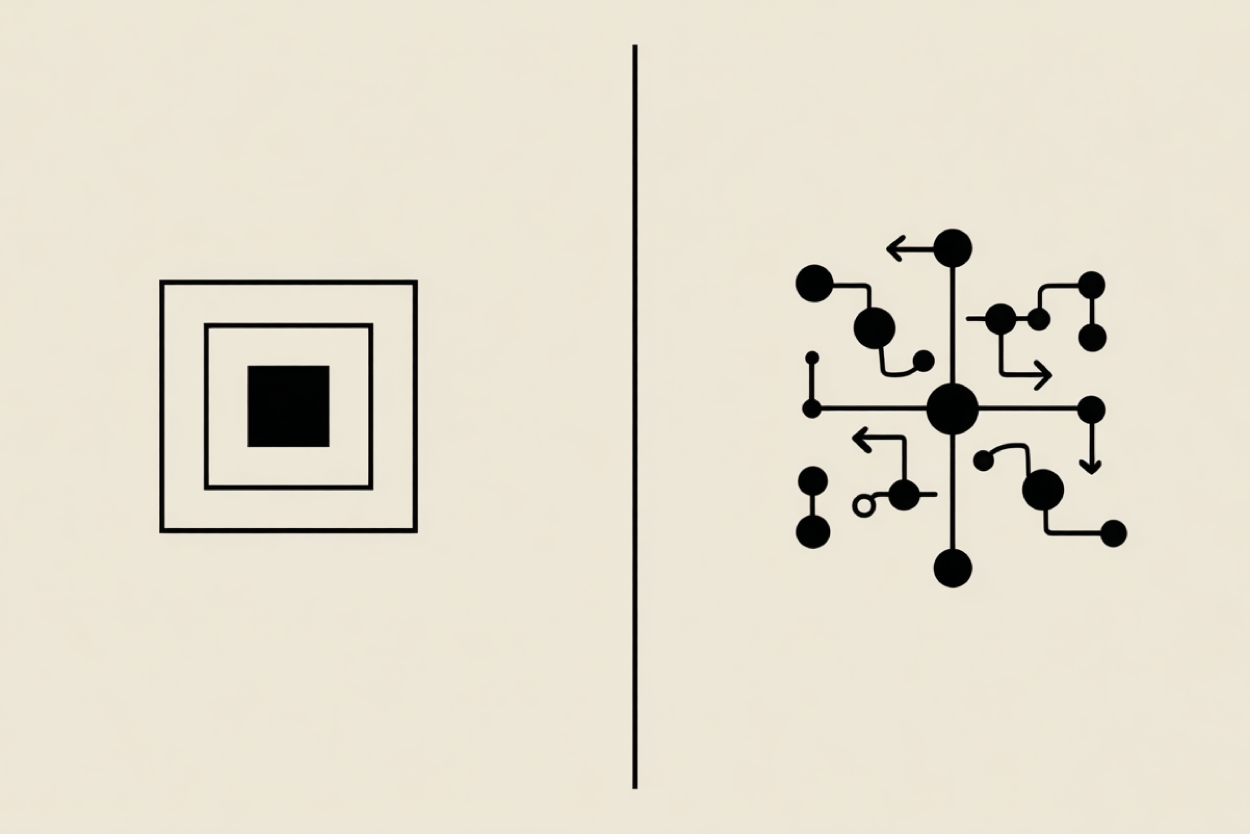

So what can an asset owner do to maintain confidence during these stressful periods? The answer lies in couching expectations in longer-term performance. But, a discerning reader might say, in the example above the 15-year return vs. the S&P 500 through 2023 was negative. And that’s correct—it’s why we advocate looking at historical rolling windows. In other words, examine how one-, five-, or 15-year returns looked at every point in time; for example, at the end of 2024, 2023, 2022, and so on. This approach gives a fuller picture of performance over time, rather than focusing on just one arbitrary snapshot.

The behavioral benefit of this approach is that an asset owner can see what percentage of time they would have been satisfied with overall performance, which helps to counteract the natural tendency to myopically home in on just today’s performance. For Berkshire, the rolling data from 1981 to 2024 paints a much more congenial picture, with the stock outperforming the S&P 500:

Of course, not only do you want to see how often your investment outperformed, but also the degree. Ideally, you want the skew to be positive; i.e., when positions outperform, they outperform strongly, but when they underperform, the underperformance is limited. Not incidentally, Berkshire also does well on that front:

Ultimately, looking at longer-term performance through the lens of rolling time periods allows an asset owner to better judge whether short-term underperformance is just a temporary dip or a sign of something deeper. It adds context, perspective, and discipline whenever emotions and headlines tempt otherwise.

4 min read

A September to Remember? Rates, Labor, and Market Domino Effects Setting the Stage As markets came back from the long Labor Day weekend, labor...

4 min read

Thinking about the past year at Crewcial, a John Lennon quote keeps coming to mind: “Being honest may not get you a lot of friends, but it’ll always...

2 min read

The past few weeks were a good reminder of how strange markets can be, yet momentum has shifted in ways that feel familiar to anyone who has watched...