"CLOUDED COMPASS"

GLOBAL MARKET SUMMARY

2025 | Q1

US

After two consecutive years of double-digit gains, US equity markets reversed course and ended the quarter in negative territory. Longer-range economic data points to continued resilience, with steady unemployment, spending, and inflation. However, policy uncertainty made for a clouded macroeconomic backdrop. Consumer sentiment declined sharply in March to its lowest level since 2022, with participants expressing elevated levels of concern about the overall economic outlook and labor market.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate at its “moderately restrictive” level of 4.25-4.50% in light of current economic uncertainty. While no significant changes were made to the policy statement or economic outlook, the Federal Reserve (the Fed) modestly downgraded its economic forecast over the next few years, with economic growth slightly less than previously forecasted and inflation modestly higher. Its balance sheet declined by $100 billion to $6.8 trillion, but the pace of decline is expected to fall; beginning April 1st, the runoff of US treasuries will decrease from $25 billion to $5 billion per month. Federal-funds futures predict a 3.6% rate by year-end 2025, 30 basis points below the Fed’s projection.

The commercial real-estate market continued to show signs of stabilization in the first quarter of 2025. As of February, the RCA National All-Property Commercial Price Index recorded a 1.3% year-over-year increase and a 0.6% rise month over month.

While certain areas of the commercial real-estate markets remain challenged by structural headwinds, a more favorable macroeconomic backdrop encouraged renewed investor interest, with even the office sector showing early signs of recovery. The first two months of 2025 represented the strongest start to the year for Manhattan office-leasing activity in over a decade

row-spacer

row-spacer

EUROPE

In Q4 2024, GDP was essentially flat across the Eurozone. Germany and France saw slight contractions in Q4, while Spain grew a robust 0.8%. Services continued to be the main driver of growth, outpacing manufacturing. The services PMI was in expansion territory throughout the quarter (50.6–51.3) as consumer-facing and business services firms saw improving activity. After contracting in late 2024, private-sector output returned to modest growth.

The Eurozone composite PMI (Purchasing Managers’ Index) edged back above the 50 threshold that separates growth from contraction, climbing further to 50.9 by March, a seven-month high. Input-cost inflation and output-charge inflation in services fell to their lowest level in about two years in March, reflecting easing energy costs and wage growth. The European Central Bank (ECB) continued to pivot toward further monetary easing in Q1 2025. In February and March, the ECB Governing Council delivered consecutive 25 bps rate cuts, bringing the deposit facility rate down to ~2.5% by the end of Q1. By March, markets fully expected another 25 bps cut at the April meeting. ECB President Christine Lagarde emphasized a cautious, agile, data-driven approach amid an escalation of global trade tensions.

Germany’s new government led by Friedrich Merz of the center-right CDU/CSU has charted a dramatic shift in fiscal policy aimed at stimulating growth, with substantial investments in military modernization and public infrastructure. The political mandate for these measures was buttressed by the broad left-right coalition, which came together amid “new urgency” as Germany faces a potential trade-war shock from US tariffs.

CHINA

China’s economic growth during Q1 2025 showed mixed results. Retail sales showed modest growth driven by holiday spending and policy measures aimed at boosting domestic consumption; export growth slowed significantly from weaker global demand and escalating trade tensions with the US.

China introduced several measures in 2025 to stimulate economic growth, while the People’s Bank of China (PBOC) has adopted a “moderately loose” monetary policy stance, reflecting expected interest-rate cuts and a reduction in the reserve requirement ratio.

In April, US President Donald Trump raised tariffs to 145% across a wide range of Chinese imports; Beijing responded with a 125% tariff on US goods, effectively choking off the market for American exports. The longer-term effects of these tensions could significantly disrupt global trade patterns and economic stability.

In the realm of AI, Chinese startup DeepSeek made significant strides, challenging established players with innovative and cheaper solutions. This rapid advancement aligns with China’s government-backed push to become a global leader in AI by 2030.

JAPAN

Japan’s real GDP expanded solidly in the fourth quarter of 2024, marking the third straight quarter of expansion. Early indications for Q1 2025 suggested the economy continued growing, but at a modest pace. After a tentative rise over the winter holidays, spending momentum faltered early in the new year. Industrial production and export data were mixed, while looming external risks (notably US trade policy shifts) began to cloud the outlook.

The Bank of Japan’s (BOJ) March 2025 Tankan survey presented a cautious outlook from manufacturing firms alongside record highs for service sector confidence. Export-oriented manufacturers, especially in sectors like steel and machinery, reported worsening conditions amid soft overseas demand, rising input costs, and uncertainty from US tariff threats, while the outlook from non-manufacturing firms was upbeat. Booming inbound tourism and the ability to pass on costs through price increases have driven record profits in hospitality, retail, and other services, resulting in decades-high optimism.

The BOJ opted to hike rates at its January meeting by 25 bps (to 0.5%) in the midst of a policy normalization cycle. This hike brought rates to their highest level since 2008. However, at the second meeting of the quarter, policy makers struck a more cautious tone; Governor Ueda noted uncertainty over the fallout from US trade policy, while emphasizing decisions will hinge on incoming data concerning inflation, growth, and risk.

COMMODITIES

The S&P Goldman Sachs Commodity Index (SPGSCI) returned 4.89% in Q1 2025. Precious metals (+18.25%) and livestock (+5.87%) led gains, while agriculture (-1.25%) was the main detractor. Gold and silver saw strong safe-haven demand amid tariff concerns. In agriculture, cocoa's sharp drop drove underperformance, though sugar and coffee rose. Among industrial metals, copper climbed notably, nickel and lead posted modest gains, and zinc declined.

Despite a pro-crypto administration and Trump’s ambitions to make the US a crypto hub, tariff uncertainty weighed on risk assets, including digital markets, whose overall market cap fell ~18%. This overshadowed progress like Congress passing the GENIUS ACT, a bill establishing a regulatory framework for stablecoins, paving the way for large, regulated players to enter the space. Ethereum dropped over 45% and altcoins fell 35%, while Bitcoin fared better, down just 12% for the quarter.

US:

EUROPE:

According to data from Eurostat, economic growth across the Eurozone declined (-0.1% quarter over quarter) in the third quarter, as the region faced headwinds from inflation, rising interest rates, and tightened fiscal policies. Among the larger economies, France, Spain, and Belgium experienced growth while Germany contracted from persistent inflation, high energy prices, and weak foreign demand. Forward-looking economic indicators weakened for the region; the HCOB's final Composite PMI came in at 47.0. Manufacturing activity continued to contract and demand for services declined as consumers pulled back on spending. However, there was some signs of improvement in the manufacturing sub-indices tied to new orders and purchasing activity. Additionally, Eurozone unemployment remained at a record low of 6.4%; employment increased in both services and construction, offsetting weakness in the manufacturing sector. Overall, job vacancy rates have come down from their peaks but remain relatively high by historical standards.

After declining for much of the past year, the rate of inflation across the Eurozone rose to 2.9% in December. The uptick in inflation was primarily due to technical factors, as the impact of base effects and the timing of government subsidies overwhelmed slower price growth for other goods. (Note, core inflation, which doesn’t include energy, food, alcohol, and tobacco prices, ended the year at 3.4%, down from its 2022 peak.) In its last meeting of the year, the European Central Bank (ECB) reaffirmed its benchmark interest-rate policy and announced plans to phase out the last of its COVID-19 era bond-buying programs. The ECB also changed its language around inflation—from describing it as “expected to remain too high for too long,” to saying that it will “decline gradually over the course of next year.” In her statements following the meeting, ECB President Christine Lagarde assumed a more measured tone and argued against calls for imminent cuts to interest rates, stating that it’s too early to “lower our guard” and that the bank is “data dependent, not time dependent.”

CHINA:

China’s economic data in Q4 2023 presented a mixed picture. Industrial output experienced a significant rebound, growing by 4.6% (year on year) in October and an impressive 6.6% in November. This growth—the fastest pace since February 2022—underscored the sector’s recovery and contribution to the economy. On the other hand, already affected by a downturn in the property sector, reduced land sale revenue, and a slowdown in export manufacturing, consumer spending was further impacted by household deleveraging. Credit cards and mortgage loans saw a decline, indicating caution among consumers. Overall spending remained below pre-COVID levels, suggesting a slow and gradual path towards recovery.

In response to the property market's challenges, the Chinese government rolled out several initiatives, including reducing down-payment thresholds and mortgage interest rates, and easing restrictions on second-home purchases. Such measures were designed to ease financial pressure on homebuyers and stimulate market activity. Another notable development was the provision of low-cost financing, amounting to CN¥1 trillion, for urban village renovations and affordable housing projects. This significant investment is intended to support the real-estate sector, a critical component of China's economy. Early indications suggest a positive reception from homebuyers, particularly in major cities, signaling a potential upturn in the real-estate market.

The November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden was a landmark event. Key topics included curbing illicit fentanyl production and military cooperation, alongside a dialogue on artificial intelligence emphasizing the importance of managing risks and safety issues. Described as ‘constructive and productive,’ the meeting underlined both leaders' desire for peaceful coexistence and the necessity of avoiding miscommunication. While it did not resolve all critical geopolitical issues, the meeting was viewed as a positive step towards stabilizing US-China relations. The meeting's conciliatory tone and focus on cooperation in specific areas signaled a potential easing of the strained relations between the two nations.

JAPAN:

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

COMMODITIES:

The S&P Goldman Sachs Commodity Index (SPGSCI) ended the quarter down with a total return of 10.73%, driven mainly by price gains for industrial metals and precious metals failing to offset weaker prices for energy, agriculture, and livestock. Contrary to Q3 2023, energy (16.74%; S&P GSCI Energy—SPGSEN) underperformed all other SPGSCI sub-index constituents, with sharply lower prices for crude oil, natural gas, and gas oil. These detractors to performance occurred despite output cuts from OPEC+. Agriculture (0.73%; S&P GSCI Agriculture—SPGSAG) ended the quarter with higher prices for soybeans, coffee, wheat, and cocoa failing to offset considerable price declines for sugar, corn, cotton, and Kansas wheat. The precious metals segment outperformed all other commodity constituents during the quarter (10.99%; S&P GSCI Precious Metals—SPGSPM), as both gold and silver achieved robust price gains during Q4 2023. The industrial metals segment realized a modest gain during the quarter (0.82%; S&P GSCI Industrial Metals—SPGSIM), as prices for aluminum, copper, and zinc offset weaker prices for nickel and lead.

Following a relatively quiet period in Q2/Q3 2023, the digital-assets market performed well during Q4. The premier digital token, Bitcoin, was up 57% in Q4 2023, while the second most-popular digital token, Ethereum (ETH), was up 37%, bringing the yearly returns to 155% and 91%, respectively. Speculation over the approval by the Securities and Exchange Commission (SEC) of a US spot Bitcoin exchange-traded fund (ETF) was a significant driver of price movements during the period; this was subsequently approved in January 2024.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

EUROPE

According to data from Eurostat, economic growth across the Eurozone declined (-0.1% quarter over quarter) in the third quarter, as the region faced headwinds from inflation, rising interest rates, and tightened fiscal policies. Among the larger economies, France, Spain, and Belgium experienced growth while Germany contracted from persistent inflation, high energy prices, and weak foreign demand. Forward-looking economic indicators weakened for the region; the HCOB's final Composite PMI came in at 47.0. Manufacturing activity continued to contract and demand for services declined as consumers pulled back on spending. However, there was some signs of improvement in the manufacturing sub-indices tied to new orders and purchasing activity. Additionally, Eurozone unemployment remained at a record low of 6.4%; employment increased in both services and construction, offsetting weakness in the manufacturing sector. Overall, job vacancy rates have come down from their peaks but remain relatively high by historical standards.

After declining for much of the past year, the rate of inflation across the Eurozone rose to 2.9% in December. The uptick in inflation was primarily due to technical factors, as the impact of base effects and the timing of government subsidies overwhelmed slower price growth for other goods. (Note, core inflation, which doesn’t include energy, food, alcohol, and tobacco prices, ended the year at 3.4%, down from its 2022 peak.) In its last meeting of the year, the European Central Bank (ECB) reaffirmed its benchmark interest-rate policy and announced plans to phase out the last of its COVID-19 era bond-buying programs. The ECB also changed its language around inflation—from describing it as “expected to remain too high for too long,” to saying that it will “decline gradually over the course of next year.” In her statements following the meeting, ECB President Christine Lagarde assumed a more measured tone and argued against calls for imminent cuts to interest rates, stating that it’s too early to “lower our guard” and that the bank is “data dependent, not time dependent.”

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

CHINA

China’s economic data in Q4 2023 presented a mixed picture. Industrial output experienced a significant rebound, growing by 4.6% (year on year) in October and an impressive 6.6% in November. This growth—the fastest pace since February 2022—underscored the sector’s recovery and contribution to the economy. On the other hand, already affected by a downturn in the property sector, reduced land sale revenue, and a slowdown in export manufacturing, consumer spending was further impacted by household deleveraging. Credit cards and mortgage loans saw a decline, indicating caution among consumers. Overall spending remained below pre-COVID levels, suggesting a slow and gradual path towards recovery.

In response to the property market's challenges, the Chinese government rolled out several initiatives, including reducing down-payment thresholds and mortgage interest rates, and easing restrictions on second-home purchases. Such measures were designed to ease financial pressure on homebuyers and stimulate market activity. Another notable development was the provision of low-cost financing, amounting to CN¥1 trillion, for urban village renovations and affordable housing projects. This significant investment is intended to support the real-estate sector, a critical component of China's economy. Early indications suggest a positive reception from homebuyers, particularly in major cities, signaling a potential upturn in the real-estate market.

The November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden was a landmark event. Key topics included curbing illicit fentanyl production and military cooperation, alongside a dialogue on artificial intelligence emphasizing the importance of managing risks and safety issues. Described as ‘constructive and productive,’ the meeting underlined both leaders' desire for peaceful coexistence and the necessity of avoiding miscommunication. While it did not resolve all critical geopolitical issues, the meeting was viewed as a positive step towards stabilizing US-China relations. The meeting's conciliatory tone and focus on cooperation in specific areas signaled a potential easing of the strained relations between the two nations.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

JAPAN

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

COMMODITIES

The S&P Goldman Sachs Commodity Index (SPGSCI) ended the quarter down with a total return of 10.73%, driven mainly by price gains for industrial metals and precious metals failing to offset weaker prices for energy, agriculture, and livestock. Contrary to Q3 2023, energy (16.74%; S&P GSCI Energy—SPGSEN) underperformed all other SPGSCI sub-index constituents, with sharply lower prices for crude oil, natural gas, and gas oil. These detractors to performance occurred despite output cuts from OPEC+. Agriculture (0.73%; S&P GSCI Agriculture—SPGSAG) ended the quarter with higher prices for soybeans, coffee, wheat, and cocoa failing to offset considerable price declines for sugar, corn, cotton, and Kansas wheat. The precious metals segment outperformed all other commodity constituents during the quarter (10.99%; S&P GSCI Precious Metals—SPGSPM), as both gold and silver achieved robust price gains during Q4 2023. The industrial metals segment realized a modest gain during the quarter (0.82%; S&P GSCI Industrial Metals—SPGSIM), as prices for aluminum, copper, and zinc offset weaker prices for nickel and lead.

Following a relatively quiet period in Q2/Q3 2023, the digital-assets market performed well during Q4. The premier digital token, Bitcoin, was up 57% in Q4 2023, while the second most-popular digital token, Ethereum (ETH), was up 37%, bringing the yearly returns to 155% and 91%, respectively. Speculation over the approval by the Securities and Exchange Commission (SEC) of a US spot Bitcoin exchange-traded fund (ETF) was a significant driver of price movements during the period; this was subsequently approved in January 2024.

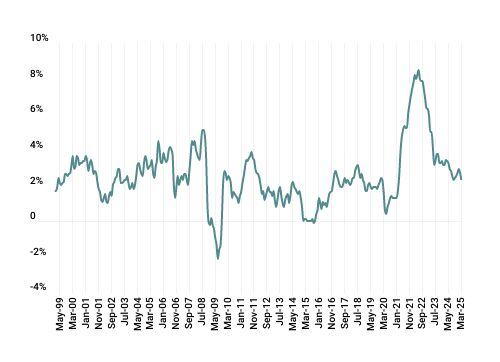

ROLLING 12-MONTH CONSUMER PRICE INDEX

25 YEARS THROUGH JUNE 2024

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1% in March after a gain of 0.2% in February. The CPI All-Items Index exhibited similar signs of deceleration, gaining 2.4% for the twelve months ending March after rising 2.8% over the twelve months ending February. Over the past twelve months, the major contributors were energy (+4.2%), shelter (+4.0%), and food (+3.0%).

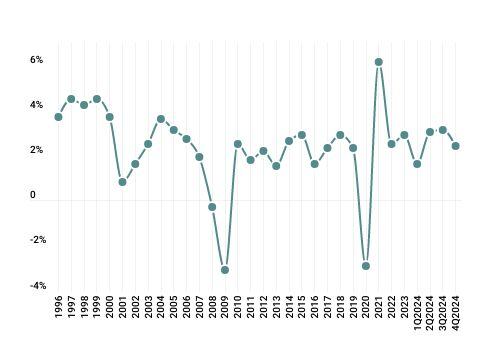

REAL GROSS DOMESTIC PRODUCT

25 YEARS THROUGH Q1 2024

During Q4 2024, real GDP increased at a rate of 2.4%, maintaining its positive trajectory but slowing from the prior quarter. The increase in real GDP primarily reflected an increase in consumer and federal government spending. The primary contributors were a 2.0% increase for private-services-producing industries and an increase of 3.1% for the government sector; durable-goods manufacturing, wholesale trade, and other services (non-government) were notable detractors.

RETAIL SALES

Total retail and food sales rose 1.4% from the previous month and 4.6% over the last twelve. This increase ran counter to recent readings indicating declines in consumer sentiment, suggesting that some shoppers may be accelerating purchases in anticipation of future tariffs. Motor-vehicle and parts retailers significantly contributed to this increase (+8.8% YOY), while gas stations and department stores detracted (-4.3% and -2.5% YOY, respectively).

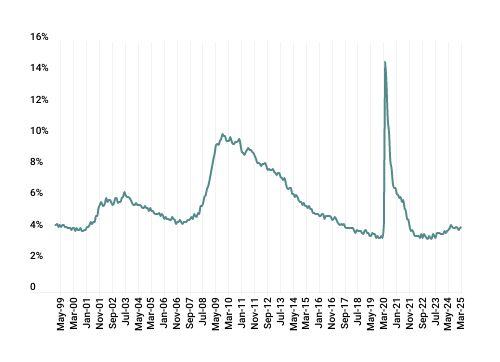

Unemployment RATE

25 YEARS THROUGH june 2024

The US economy added 228,000 jobs in March 2025, ahead of the trailing twelve-month average gain of 158,000. March’s job gains occurred within the healthcare and social assistance (+78,000), retail trade (+24,000), government (+33,000), and transportation and warehousing (+23,000) industries. The unemployment rate of 4.2% was up slightly from the prior quarter, while the labor-force participation rate remained unchanged at 62.5%. Wage growth trends were similarly static, with average hourly earnings for all employees on private non-farm payrolls increasing by 0.2 % in March and 3.8% over the past twelve months.

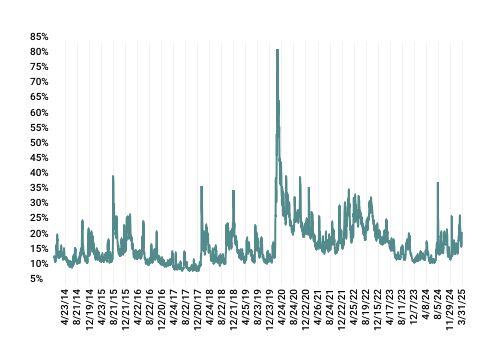

CBOE VIX DAILY CLOSING VALUES

LAST 10 YEARS

Market volatility, as measured by the VIX Index, had an average close in Q1 2025 of 18.5. The index spiked dramatically in early March after President Trump announced new trade policies, including extensive tariffs on America's closest trading partners, Canada, Mexico, and China. The index subsequently retreated while remaining elevated after the president walked back some of the tariff amounts and delayed the implementation of others.

CPI

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in December, following a 0.1% increase in November. The all-items index rose 3.4% before seasonal adjustment over the previous twelve months. Over the past twelve months, the major contributors include transportation services, up 9.7% (driven by motor-vehicle insurance, up 20.3%), tobacco and smoking products, up 7.8%, and shelter, up 6.2%.

GDP

During Q3 2023, real GDP rose at an annual rate of 4.9% followed by a 2.1% increase in Q2 2023. The increase was driven by consumer spending and inventory investment; imports also increased. Overall, 14 of 22 industry groups contributed to real GDP growth in the third quarter; the value added from private goods-producing industries was particularly strong at 10.2%.

Retail Sales

Total retail and food sales increased 0.3% and 4.1% month-to-date and year-to-date ending November 2023, respectively. Total sales from September through November 2023 were up 3.4% compared to the same period one year ago; the percentage change over the same period was up 0.4%. Significant contributors include non-store retailers and food services and drinking places.

Unemployment

VIX

Market volatility, as measured by the VIX Index, had an average close in Q4 2023 at 15.29, trending up from Q3 (15.01) and down from Q2 (16.48). The index has dropped below its five-year average of 20.58, reflecting positive investor sentiment and a high level of comfort with the overall direction of the economy.

GMS Table Templates

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |||

| Header | Q4 2023 | YTD | Q4 2023 | YTD |

|

Title1

|

0%

|

0%

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Title1

|

Value

|

|

Title2

|

Value

|

|

Title3

|

Value

|

|

Title4

|

Value

|

|

Title5

|

Value

|

|

Title6

|

Value

|

|

Title7

|

Value

|

|

Title8

|

Value

|

|

Title9

|

Value

|

|

Title10

|

Value

|

|

Title11

|

Value

|

|

Title12

|

Value

|

|

Title13

|

Value

|

Returns by style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

SECTOR Returns BY CAPITALIZATION

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Basic Materials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Goods

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Services

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Financials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Health Care

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Industrials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Oil & Gas

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Real Estate

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Technology

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Telecommunications

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Utilities

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments & Industry Classification Benchmark

|

||||||

|

Large Cap: Russell Top 200 Index | Mid Cap: Russell Mid Cap Index | Small Cap: Russell 2000 Index

|

||||||

us valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Large Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Mid Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Small Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

international valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| International Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| Emerging Markets Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments Total Equity Profile

|

||||

non-us developed / emerging cap & style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Australia

|

Value

|

|

Brazil

|

Value

|

|

Canada

|

Value

|

|

China

|

Value

|

|

France

|

Value

|

|

Germany

|

Value

|

|

Hong Kong

|

Value

|

|

Indonesia

|

Value

|

|

Italy

|

Value

|

|

Japan

|

Value

|

|

Mexico

|

Value

|

|

Singapore

|

Value

|

|

Spain

|

Value

|

|

Thailand

|

Value

|

SECTOR Returns BY CAPITALIZATION:

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q1 2025 | YTD | Q1 2025 | YTD | Q1 2025 | YTD | |

| Basic Materials | 10.0 | 10.0 | -0.2 | -0.2 | -6.0 | -6.0 |

| Consumer Goods | 11.8 | 11.8 | 3.8 | 3.8 | 0.4 | 0.4 |

| Consumer Services | -10.6 | -10.6 | -8.3 | -8.3 | -14.5 | -14.5 |

| Financials | 4.0 | 4.0 | -0.2 | -0.2 | -4.1 | -4.1 |

| Health Care | 7.1 | 7.1 | -4.3 | -4.3 | -8.4 | -8.4 |

| Industrials | 0.6 | 0.6 | -7.1 | -7.1 | -10.7 | -10.7 |

| Oil & Gas | 10.9 | 10.9 | 6.0 | 6.0 | -13.5 | -13.5 |

| Real Estate | 7.1 | 7.1 | 1.7 | 1.7 | -3.0 | -3.0 |

| Technology | -13.0 | -13.0 | -9.6 | -9.6 | -21.2 | -21.2 |

| Telecommunications | 6.2 | 6.2 | -2.5 | -2.5 | -6.0 | -6.0 |

| Utilities | 5.8 | 5.8 | 6.5 | 6.5 | 3.6 | 3.6 |

| Source: Russell Investments & Industry Classification Benchmark | ||||||

| Large Cap: Russell Top 200 Index | Mid Cap: Russell Mid Cap Index | Small Cap: Russell 2000 Index | ||||||

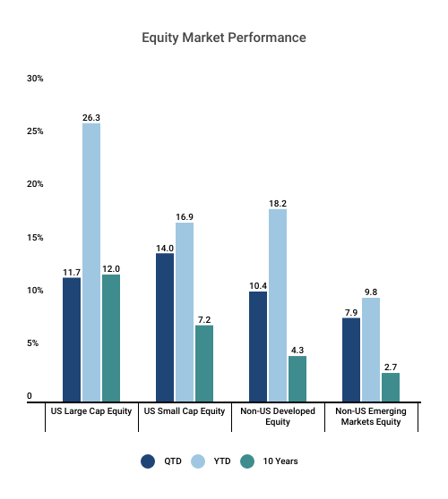

GLOBAL EQUITY PERFORMANCE

The MSCI EAFE and Emerging Market indices gained 6.9% and 2.9%, respectively, while US large-cap equities declined by 4.3%. International equity markets had a robust start to the year while US stocks struggled due to policy uncertainty and concerns over potential trade wars. Fund flows into international equities notably picked up from 2024 and were further enhanced by the negative performance of the dollar, which experienced a decline against major currencies of approximately 8.2% during this period.

The MSCI All Country World Index (ACWI) ex-US gained 5.2% in Q1 2025. Spain (+22.4%) and Norway (+20.7%) were the top-performing country indices. Spanish markets reached a level not seen since 2008; performance was driven by a combination of solid economic growth and corporate earnings. Norway benefited from the performance of its energy and financial sectors. Emerging Europe, including the Czech Republic (+28.7%), Greece (+23.4%), and Poland (+31.3%) outpaced other emerging-market countries as investors looked favorably on higher growth rates and attractive fundamentals, viewing the countries as beneficiaries of Germany’s increased fiscal spending. Thailand was the worst-performing emerging market (-13.7%) due to growth concerns.

row-spacer

row-spacer

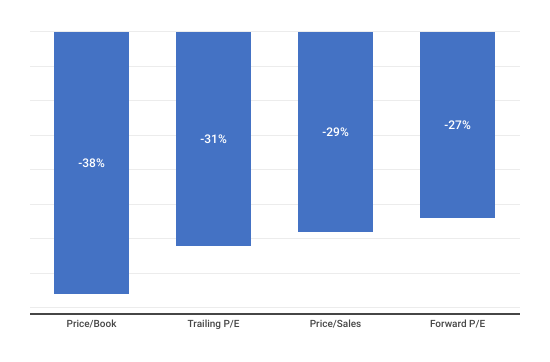

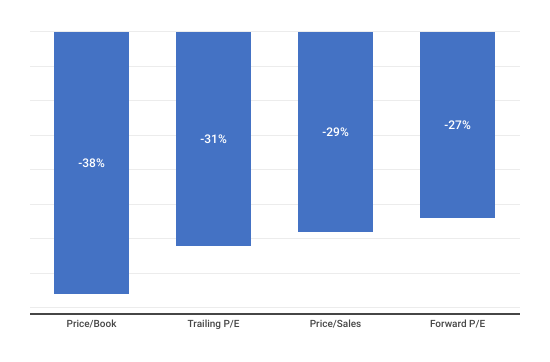

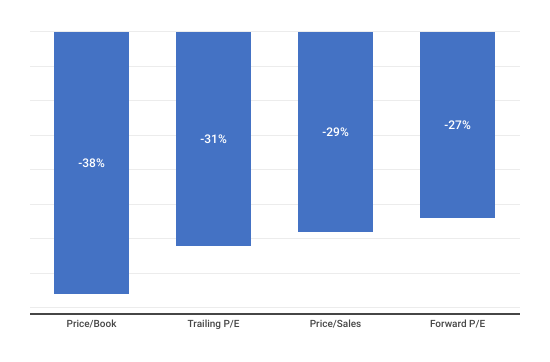

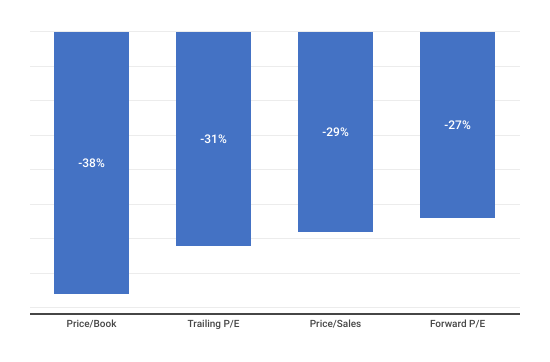

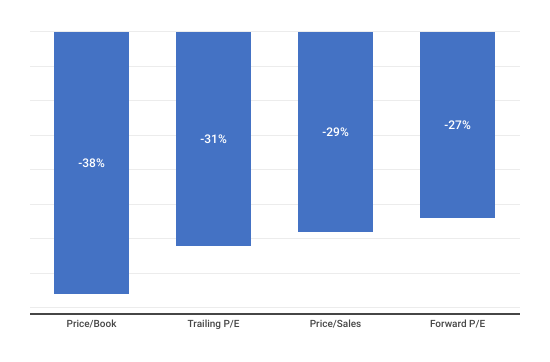

US VALUATIONS

US equities are expected to grow earnings by 7.3% YOY for Q1 2025; seven of the eleven sectors are projected to increase earnings, led by healthcare (+35%), information technology (+15%), and utilities (+10%), while energy (-14%), materials (-11%), and consumer staples (-8%) are expected to post declines. Analyst estimates currently predict earnings and revenue growth of 11% and 5%, respectively, for calendar-year 2025.

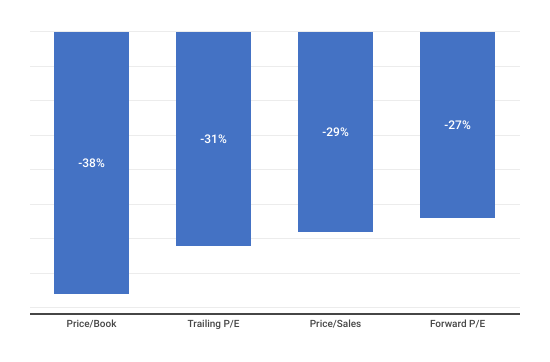

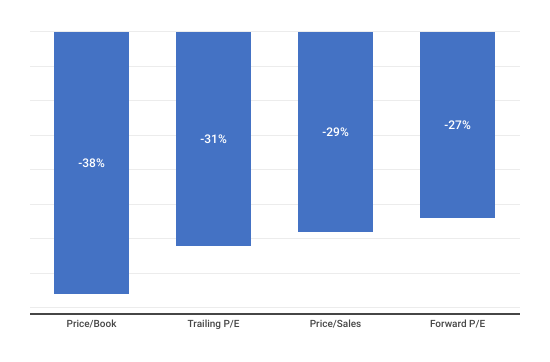

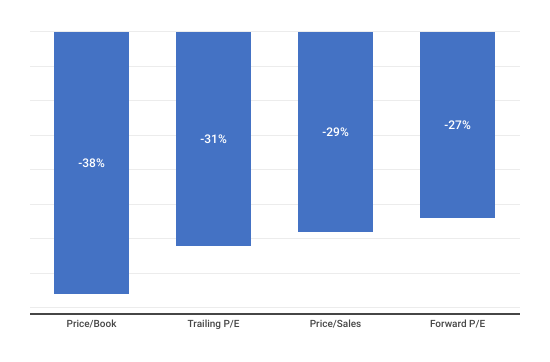

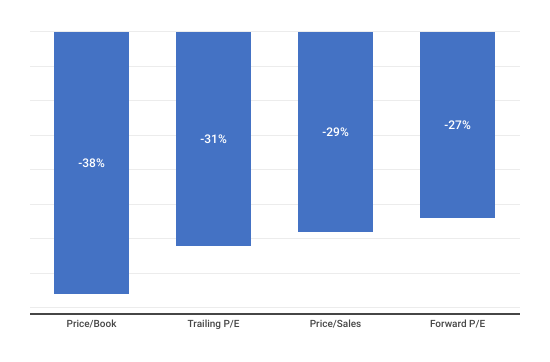

Price multiples contracted across all size and style pairings save for large-cap value equities. Valuation compression was more pronounced for growth across small-, mid-, and large-cap equities, with large-cap growth stocks experiencing the largest decrease on a relative basis. On a normalized basis, the S&P 500 Index remains expensively priced, trading at a cyclically adjusted P/E (CAPE) more than two standard deviations above its long-term average.

| Quarter Ending 3/31/2025 | Quarter Ending 12 /31/2024 | |||

| US Large Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

22.6 | 32.9 | 23.4 | 40.3 |

|

IBES LT Growth (%)

|

9.7 | 17.7 | 9.0 | 16.4 |

|

1 Year Forward P/E Ratio

|

17.0 | 26.5 | 16.9 | 31.3 |

|

Negative Earnings (%)

|

4.6 | 2.0 | 5.1 | 1.9 |

| Quarter Ending 3 /31/2025 | Quarter Ending 12 /31/2024 | |||

| US Mid Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

21.6 | 35.8 | 22.1 | 43.7 |

|

IBES LT Growth (%)

|

9.1 | 17.1 | 8.9 | 14.7 |

|

1 Year Forward P/E Ratio

|

15.9 | 25.0 | 16.3 | 28.5 |

|

Negative Earnings (%)

|

7.3 | 9.5 | 7.8 | 11.4 |

| Quarter Ending 3 /31/2025 | Quarter Ending 12 /31/2024 | |||

| US Small Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

27.1 | 15.5 | 29.3 | 157.7 |

|

IBES LT Growth (%)

|

9.2 | 14.6 | 8.1 | 14.2 |

|

1 Year Forward P/E Ratio

|

12.4 | 18.2 | 13.3 | 19.9 |

|

Negative Earnings (%)

|

23.0 | 30.6 | 24.3 | 33.9 |

INTERNATIONAL VALUATIONS

Non-US developed value equities registered multiple expansion during the quarter, while valuations for growth equities experienced a modest decline. On both an absolute and relative basis, international equities continue to trade at a discount relative to historical averages (as compared to US equities). Emerging-market valuations trended lower during the quarter and remain cheap on both an absolute and relative basis.

| Quarter Ending 3 /31/2025 | Quarter Ending 12/31/2024 | |||

| International Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

13.0 | 25.6 | 13.3 | 26.8 |

|

IBES LT Growth (%)

|

7.8 | 13.1 | 6.4 | 12.9 |

|

1 Year Forward P/E Ratio

|

11.3 | 21.2 | 10.5 | 21.8 |

|

Negative Earnings (%)

|

3.2 | 3.8 | 5.7 | 3.2 |

| Emerging Markets Equity | Quarter Ending 3 /31/2025 | Quarter Ending 12 /31/2024 |

|

Price/Earnings Ratio

|

15.5 | 16.1 |

|

IBES LT Growth (%)

|

14.1 | 16.7 |

|

1 Year Forward P/E Ratio

|

12.9 | 13.1 |

|

Negative Earnings (%)

|

2.7 | 3.0 |

|

Source: Russell Investments Total Equity Profile

|

||

non-us developed / emerging cap & style: MSCI AC WORLD EX - US INDICES

(SOURCE: MSCI - DATA SOURCED 'AS IS')

| Q1 2025 | YTD | Q1 2025 |

YTD

|

||

|

Large Cap Value

|

9.4% | 9.4% | Large Cap Growth | 1.7% | 1.7% |

|

Mid Cap Value

|

5.7% | 5.7% | Mid Cap Growth | 2.8% | 2.8% |

|

Small Cap Value

|

2.9% | 2.9% | Small Cap Growth | -1.7% | -1.7% |

| Country | Best Performing Style |

| Australia | Value |

| Brazil | Value |

| Canada | Growth |

| China | Growth |

| France | Value |

| Germany | Value |

| Hong Kong | Value |

| Indonesia | Value |

| Italy | Value |

| Japan | Value |

| Mexico | Growth |

| Singapore | Growth |

| Spain | Value |

| Thailand | Value |

| United Kingdom | Value |

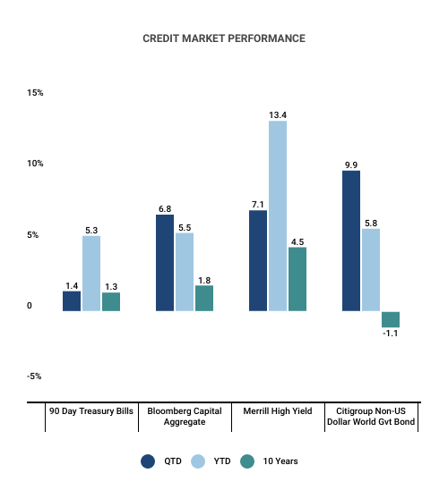

US SPREAD PRODUCTS

Investment-Grade Corporate Bonds: The market returned 2.3% for the quarter; falling Treasury yields and contractual coupons drove gains. Spreads widened by 14 bps (to 94 bps), still near historic lows and 25 bps below the ten-year median. Higher-quality issues outperformed: Aa-rated corporates, 2.9%; A-rated, 2.4%; and Baa-rated, 2.3%. Quarterly issuance rose 4% YOY to $560 billion.

High-Yield Corporate Bonds: The market returned 1.0% for the quarter; falling Treasury yields and contractual coupons drove gains. Spreads widened by 60 bps (to 347 bps), still near historic lows and 33 bps below the ten-year median. Higher-quality bonds led performance: Ba-rated corporates, 1.5%; B-rated, 70 bps; and Ca-rated, -40 bps. Quarterly issuance fell 10% YOY to $80 billion.

hello world

GDP

During Q3 2023, real GDP rose at an annual rate of 4.9% followed by a 2.1% increase in Q2 2023. The increase was driven by consumer spending and inventory investment; imports also increased. Overall, 14 of 22 industry groups contributed to real GDP growth in the third quarter; the value added from private goods-producing industries was particularly strong at 10.2%.

Retail Sales

Total retail and food sales increased 0.3% and 4.1% month-to-date and year-to-date ending November 2023, respectively. Total sales from September through November 2023 were up 3.4% compared to the same period one year ago; the percentage change over the same period was up 0.4%. Significant contributors include non-store retailers and food services and drinking places.

Unemployment

A total of 494,000 jobs were created in the fourth quarter of 2023, which did not outpace the previous quarter’s gains of 710,000. The US economy added 216,000 jobs in November, which is below the twelve-month average monthly gain of 225,000. December’s notable job gains occurred within the following industries: government (+52,000), health care (+38,000), social assistance (+21,000), and construction (+17,000).

The unemployment rate remains unchanged from the previous quarter’s average at 3.7%. The number of unemployed persons (6.3 million) experienced minimal net movement as well. The labor force participation rate decreased by 0.3% in December (62.5%).

VIX

During Q2 2023, real GDP rose at an annual rate of 2.1%, following a 2.2% increase in Q1. The increase was driven by state and local government spending, non-residential fixed investment, and consumer spending, partially offset by a decrease in exports; imports also decreased. Relative to Q1, the second quarter experienced a slowdown in consumer and federal government spending alongside the decline in exports, which drove the Q2 deceleration of real GDP.

Charts

YIELD CURVE

US Treasury yields fell by approximately 20-40 bps across the curve, with modest but noteworthy steepening at the long end. The two-year note closed at 3.89%, the ten-year note at 4.23%, and the 30-year note at 4.59%. The two- to ten-year spread widened by 1 bp (+34 bps), the highest level since mid-2022 but below the historical +85 bps average, while the five- to 30-year spread widened by 23 bps (+63 bps), largely due to policy-related turbulence. Despite volatility, the yield curve has remained relatively flat within a 3.5-5.0% range for over two years. Key drivers have included solid economic growth, historically wide fiscal deficits, persistently elevated inflation, and until recently, expectations for a pro-growth policy agenda.

Love these and want more?

Enter your email address below and we will let you know when we add new resources.