QUARTERLY COMMENTARY

2024 | Q1

Crisis Negotiation

Creating space for volatile emotion to attenuate to rationality.

Published April 2, 2024

Standoff

In the heart of Brooklyn between Bushwick and Bedford-Stuyvesant in the winter of 1973, a sporting-goods store named John and Al's became the center of a harrowing hostage crisis that would test the resolve and tactics of Harvey Schlossberg and the New York City Police Department (NYPD). Four armed men, spurred to secure a cache of weaponry by the recent Hanafi Muslim massacre in Washington, DC, embarked on a robbery that escalated into a 47-hour standoff, leaving one officer dead and the city on edge.

On a Friday, January 19, the quartet casually entered John and Al's—a store already familiar with the unwelcome attention of robbers. The scene swiftly escalated, as the men, cryptically only identifying themselves as "one," "two," "three," and "four," produced a sawed-off shotgun and three handguns, supplementing their firepower with additional weaponry sourced within the store.

Around half an hour later, the NYPD's 90th Precinct received an alert, prompted by the store's silent alarm and a resourceful student from nearby Bushwick High School who had managed to evade his would-be captors. As the initial responders arrived, gunfire followed almost immediately. The perpetrators, using the store owner as a human shield, left an officer wounded in the arm and another struck in the abdomen before retreating back into the store; fortunately, the store owner managed to escape in the chaos. However, the armed quartet regrouped inside, securing twelve hostages; this soon led to another exchange of gunfire following the subsequent deployment of the NYPD's Emergency Service Unit (ESU).

Soon after the unit’s arrival on the scene, an ESU officer was shot and lost his life while seeking cover behind a railway pillar near the store. Another was struck in his knee while attempting to rescue or retrieve the downed officer.

Following this flare-up, within the hour, the NYPD had established a safe perimeter and a command post from which to better control the situation. Now arrived and at the helm of the crisis response team was Harvey Schlossberg, a recently appointed NYPD head psychologist with an innovative approach. In an era dominated by “shock and awe” tactics focused on deadly force—with greater emphasis on defeating hostage-takers than saving hostages—Schlossberg advocated patience, diplomacy, and an understanding of the psychology of the offenders.

Schlossberg, whose background included a doctorate in clinical psychology, had recently been promoted from traffic officer. At the time, the NYPD did not have a fixed protocol for hostage situations; however, several high-profile incidents nationwide and globally through the early 1970s led to a more immediate emphasis on the development of such a response.

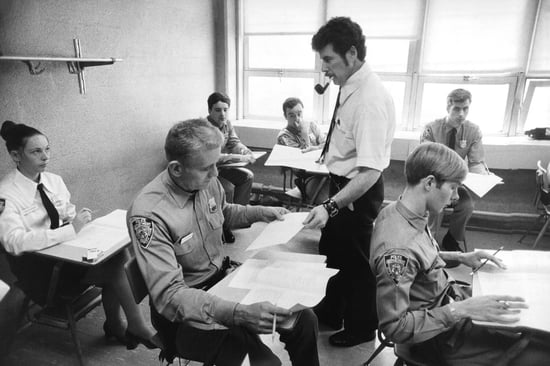

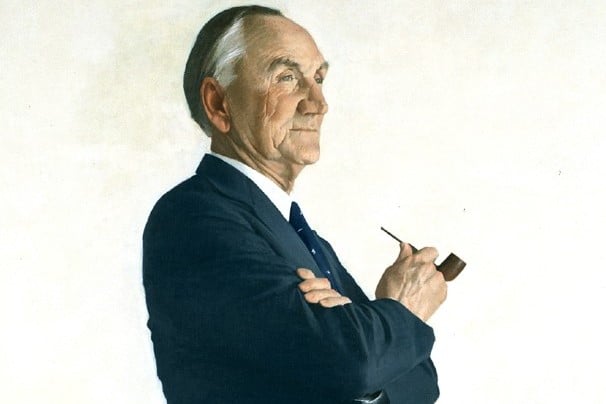

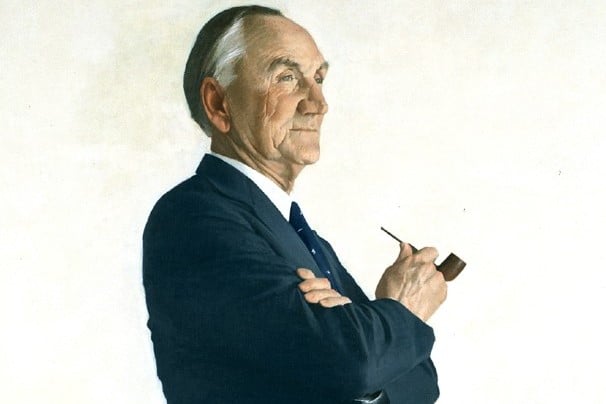

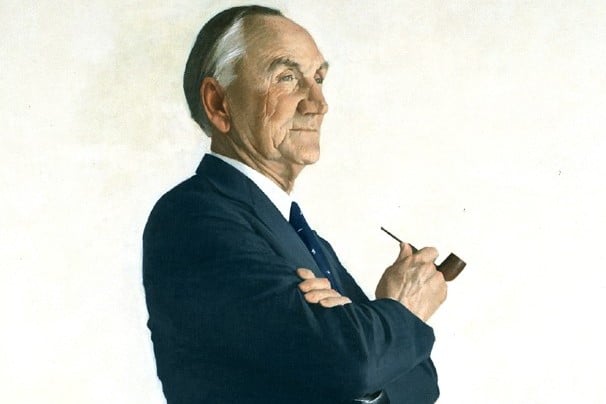

NY Times: Dr. Harvey Schlossberg conducting a class for New York City police officers in 1972.

While the NYPD ultimately opted to try Schlossberg's more peaceable crisis-management techniques, many officers at the scene wanted payback for the death of a fellow officer—including another NYPD psychologist who recommended deploying tear gas preceding a tactical assault of the store—and were reluctant to cede control.

All eyes were now on Schlossberg, and his success or failure was to determine the philosophy and trajectory of such negotiations for decades to come.

Negotiating Uncertainty

Crisis is never good when you least expect it. It implies panic and unpredictability, an undermining of well-laid plans. However, it is a steadfast companion to all human endeavor. In the high-stakes world of hostage negotiation, crisis is the operative principle. Correctional officers, federal agents, psychologists, professional negotiators, and diplomats, etc., have to understand crisis as a part of their job—as a navigable and controllable factor around which they both proactively and reactively tailor their strategies and tactics to achieve their ultimate aim; typically, resolving a situation with minimal loss of life.

At first glance, such high-octane negotiations may seem to have little to do with the important, though less immediately thrilling, world of institutional long-term investing. Few things could be further from the truth. Yes, the stakes are different, and yes, the actors have different goals, but successful crisis management consistently reflects foundational principles that investors focused on long-term, sustained outcomes would be wise to adopt1.

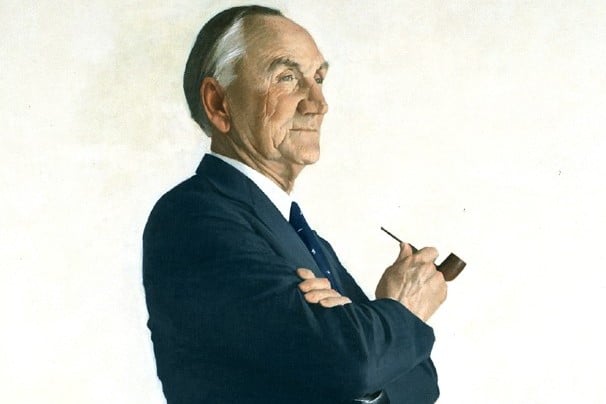

Senate Majority Leader (1961 to 1977) and Diplomat

1. Assessment

Information Gathering: For investment management, gathering information about the economic environment, market conditions, and potential risks and opportunities.

Assessing Threats: Identify threats, such as market volatility, economic downturns, or changes in regulatory environments that could impact the long-term sustainability of the institution’s community support.

2. COMMUNICATION & ACTIVE LISTENING

Initiating Contact: Establishing communication with stakeholders, donors, and community members, such as updates on financial performance and community impact initiatives.

Building Rapport & Understand Concerns: Transparently communicating investment strategies, financial goals, and the impact of community-support initiatives. Understanding stakeholder priorities is essential for aligning investment strategies with community needs.

Empathy: Demonstrate empathy by considering the social and environmental impact of investments and incorporating ethical considerations into the decision-making process.

3. Building Trust

Consistency: Consistency in financial reporting, mission alignment, and communication. Trust is built over time through reliability and transparency.

Demonstrating Competence: Showcase expertise in financial management through mission-aligned performance to instill confidence in stakeholders regarding your ability to sustainably support the community.

4. Influencing and Persuasion:

Identifying Common Ground: Find common ground between the institution’s financial goals and the community's needs. Align investments with the mission and values of the organization.

Presenting Alternatives: Explore and present various investment alternatives that balance financial returns with the long-term sustainability of community-support programs.

5. Resolution

Negotiated Agreement: Reach a financial strategy that aligns with the institution’s mission and the community's needs. This may involve adjusting investment portfolios, diversifying assets, or exploring innovative funding models.

Termination: For investing, this means the implementation of the agreed-upon investment strategy and ensuring its continued viability.

6. Debriefing and Evaluation:

Post-Incident Analysis: Analyze the impact of investments on the institution’s ability to fulfill its mandate and sustain community support in perpetuity.

Continuous Improvement: Use insights gained from evaluations to refine strategies, adapt to changing financial landscapes, and continuously improve the institution’s ability to meet its long-term goals.

Resolve

For both hostage negotiations and investment management, throughout the stages above, certain shared concepts are paramount to success. The most important among these include “dynamic inactivity,” “the web of tension,” “cohesion and synchronization,” and “tactical empathy.” All these elements addressed in tandem based on a well-defined process are responsible for successful outcomes, outweighing the siloed roles of individual members or minor deviations in execution.

COHESION/SYNCHRONIZATION

The harmonious integration of various elements, factors, or individuals involved in the decision- making process. This concept recognizes that outcomes are often influenced by multiple factors, perspectives, or stakeholders, and involves collaboration, communication, and shared understanding to enhance the overall effectiveness of decision making. The aim is to create an environment where all relevant elements work in tandem to achieve optimal outcomes. This generally involves the construction of an aligned team of contributors. Such teams are generally assembled based on the following principles: 1) limit the size of the group; 2) select people for the skills they bring to the job; 3) be sure the team has a clear idea of the goals and is committed to them; 4) ensure members hold each other accountable.

Ultimately, while the very nature of crisis situations is defined by uncertainty and tension, an aligned, synchronized team that understands the power of patience, buoyed by a disciplined process and well-ordered communication, can sometimes work miracles.

Rather than continue the assault, Schlossberg continued to negotiate. By the evening of the first day, a hostage was released in good faith to take a message to the police, demanding medical attention for the wounded hostage takers. Because the perpetrators identified as Muslim, on the second day of the standoff, several Islamic clergy members were contacted by the negotiation command post and allowed to enter the store to discuss the situation. While the perpetrators communicated that they were willing to die for their cause along with the hostages, Schlossberg kept a calm head and rightly concluded that such bravado was likely the result of still-heightened tensions and that the men involved wanted to live, as such a position seemed counteracted by the hostage-takers’ repeated requests for medical supplies, food, and cigarettes, which were provided; another hostage was released in exchange for the medical attention.

Around this time, Schlossberg and the NYPD put together a select group of individuals as a “think tank,” including key department personnel, outside experts including an additional psychologist, and specialist FBI agents. This group, using their various insights gleaned from experience and incoming on-the-ground intel, coordinated their efforts to continue to prolong the negotiations and keep the hostage-takers engaged, with the mandate to ‘slow things down and talk things out’ and dispel tension; while the robbers occasionally engaged in sporadic gunfire, the authorities, under advisement by the think tank, held their fire for the remainder of the incident in an effort to continue to ease the overall stress of the situation.

DYNAMIC INACTION

A strategic form of inactivity. Instead of

being passive or indecisive, dynamic inaction involves a deliberate choice to refrain from immediate action in order to observe, strategize, or allow a situation to unfold and attenuate. It involves a deep understanding of the complexities of a given situation alongside the recognition that immediate action may not be the most effective approach. It is a concept that recognizes the power of patience, observation, and timing in the decision-making process.

Continued communication was partially maintained by walkie-talkies, and the perpetrators allowed a member of the negotiations squad alongside a nurse to enter with supplies and new batteries. At this time, it was discovered that one of the men involved was potentially suffering from an infection along with blood poisoning, requiring immediate medical treatment beyond what the current situation allowed. The squad member and nurse also learned from the perpetrators that they were apologetic for Gilroy's death, which they had only become aware of from a radio inside the store, which further demonstrated to Schlossberg that the men were likely amendable to further discussion.

Meanwhile, in the store—unknown to the perpetrators—a hostage familiar with John and Al's knew a certain corner of one of the rooms was simply constructed of a thin plasterboard wall hiding a stairwell leading to the roof. Eventually, taking advantage of the now relatively diluted anger and stress of the hostage-takers and their growing familiarity with their captives, this man convinced the gunmen to leave the hostages in this specific corner where they would supposedly be out of the line of fire, should it come to that, which was in a separate room from the perpetrators.

TACTICAL EMPATHY

A strategic approach to understanding and influencing others by empathizing with their perspective while maintaining a clear objective. Coined by Chris Voss, a former FBI hostage negotiator, tactical empathy involves actively listening to the emotions and needs of the other party to build rapport and gain valuable insights. It goes beyond traditional empathy by integrating a tactical, goal-oriented mindset. Ultimately, it empowers individuals to grasp the emotional undercurrents of a situation, enhancing their ability to make informed decisions and reach mutually beneficial outcomes.

By this point, the ESU had begun drilling underground to construct a tunneling system in a parallel effort to potentially rescue the hostages as an alternative or coordinated last resort. As the perpetrators went to investigate this noise, the hostages were able to break through the plaster wall and escape, surprising officers who were nonetheless prepared for a potential exit from any known egress point, who shuttled the escapees to safety by lowering a ladder to bring them over to an adjacent building.

Without the hostages, all leverage was gone for the hostage-takers. However, to ensure no unnecessary loss of life on either side from a desperate last stand, Schlossberg continued to negotiate and develop a rapport with the gunmen while the NYPD and ESU contained them. Within hours, convinced they would remain unharmed and that further resistance would neither serve their cause nor lead to an escape, the perpetrators peacefully surrendered.

THE WEB OF TENSION

A complex network of interconnected and strained relationships or circumstances that create a state of stress or unease, where a disturbance in one strand can reverberate across the entire structure. Tension can arise from competing interests, power struggles, or unresolved issues, creating a delicate and potentially volatile equilibrium. Effectively navigating the web of tension requires a nuanced understanding of its components and a strategic approach to alleviate stress points.

Stepping Back From the Ledge

The NYPD's handling of the 1973 Brooklyn hostage crisis was a defining moment in US law enforcement's approach to such situations; the techniques employed became the core guiding principles for negotiations going forward. It was the first high-profile American case in which force and rash action took a back seat; psychology, restraint, and patience ended the siege.

Negotiating unexpected and stressful situations requires a steady hand and disciplined, iterative process; importantly, it boils down to certain key steps and practices that can make even the most unpredictable occurrences navigable. The unexpected is only unmanageable if you fail to account for its possibility.

At its core, success—in crisis negotiation, investment management, and most other areas of life—typically comes down to providing a space for volatile emotion to attenuate to rationality, which almost inevitably leads to a realization that rash action isn't the most desirable solution.

While the lesson may seem simple, its applications can lead to demonstrably outsized results, whether you’re involved in rescuing hostages from a dangerous standoff, or investing with a mandate to sustain your corpus in perpetuity. Cool heads prevail.

of the Earth’s land surface has been significantly altered by human actions, including 85% of wetland areas.

of ocean area is impacted by human activities, including from fisheries and pollution.

of the global population is adversely affected by land degradation.

Negotiating Uncertainty

Crisis is never good when you least expect it. It implies panic and unpredictability, an undermining of well-laid plans. However, it is a steadfast companion to all human endeavor. In the high-stakes world of hostage negotiation, crisis is the operative principle. Correctional officers, federal agents, psychologists, professional negotiators, and diplomats, etc., have to understand crisis as a part of their job—as a navigable and controllable factor around which they both proactively and reactively tailor their strategies and tactics to achieve their ultimate aim; typically, resolving a situation with minimal loss of life.

At first glance, such high-octane negotiations may seem to have little to do with the important, though less immediately thrilling, world of institutional long-term investing. Few things could be further from the truth. Yes, the stakes are different, and yes, the actors have different goals, but successful crisis management consistently reflects foundational principles that investors focused on long-term, sustained outcomes would be wise to adopt1.

Mike Mansfield

Former Senate Majority Leader (1961 to 1977) and Diplomat

The crisis you have to worry about most is the one you don’t see coming.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

JAPAN

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

GMS Table Templates

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |||

| Header | Q4 2023 | YTD | Q4 2023 | YTD |

|

Title1

|

0%

|

0%

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Title1

|

Value

|

|

Title2

|

Value

|

|

Title3

|

Value

|

|

Title4

|

Value

|

|

Title5

|

Value

|

|

Title6

|

Value

|

|

Title7

|

Value

|

|

Title8

|

Value

|

|

Title9

|

Value

|

|

Title10

|

Value

|

|

Title11

|

Value

|

|

Title12

|

Value

|

|

Title13

|

Value

|

Negotiating Uncertainty

Crisis is never good when you least expect it. It implies panic and unpredictability, an undermining of well-laid plans. However, it is a steadfast companion to all human endeavor. In the high-stakes world of hostage negotiation, crisis is the operative principle. Correctional officers, federal agents, psychologists, professional negotiators, and diplomats, etc., have to understand crisis as a part of their job—as a navigable and controllable factor around which they both proactively and reactively tailor their strategies and tactics to achieve their ultimate aim; typically, resolving a situation with minimal loss of life.

At first glance, such high-octane negotiations may seem to have little to do with the important, though less immediately thrilling, world of institutional long-term investing. Few things could be further from the truth. Yes, the stakes are different, and yes, the actors have different goals, but successful crisis management consistently reflects foundational principles that investors focused on long-term, sustained outcomes would be wise to adopt1.

"The crisis you have to worry about most is the one you don’t see coming."

Mike Mansfield

Former Senate Majority Leader (1961 to 1977) and Diplomat

Returns by style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

SECTOR Returns BY CAPITALIZATION

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Basic Materials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Goods

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Services

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Financials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Health Care

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Industrials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Oil & Gas

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Real Estate

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Technology

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Telecommunications

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Utilities

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments & Industry Classification Benchmark

|

||||||

|

Large Cap: Russell Top 200 Index | Mid Cap: Russell Mid Cap Index | Small Cap: Russell 2000 Index

|

||||||

us valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Large Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Mid Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Small Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

international valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| International Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| Emerging Markets Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments Total Equity Profile

|

||||

non-us developed / emerging cap & style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Australia

|

Value

|

|

Brazil

|

Value

|

|

Canada

|

Value

|

|

China

|

Value

|

|

France

|

Value

|

|

Germany

|

Value

|

|

Hong Kong

|

Value

|

|

Indonesia

|

Value

|

|

Italy

|

Value

|

|

Japan

|

Value

|

|

Mexico

|

Value

|

|

Singapore

|

Value

|

|

Spain

|

Value

|

|

Thailand

|

Value

|

Want to learn more about how we put these principles to work? Read first-hand accounts from our research analysts.

Part 1 of 4

Kyle Marmelstein

Part 2 of 4

Matt Van Kirk

Part 3 of 4

Peter Mitsos

Part 4 of 4

Rita Benkirane

-

Crisis Negotiations – Managing Critical Incidents and Hostage Situations in Law Enforcement and Corrections. Wayman Mullins; Andrew Young. 4th Edition

-

Never Split the Difference – Negotiating as if your life depended on it. Chris Voss with Tahl Raz. 2016

-

Three Days in January: Revisiting The Broadway Hostage Crisis of 1973. Bushwick Daily. https://bushwickdaily.com/bushwick/revisiting-the-broadway-hostage-crisis-of-1973/